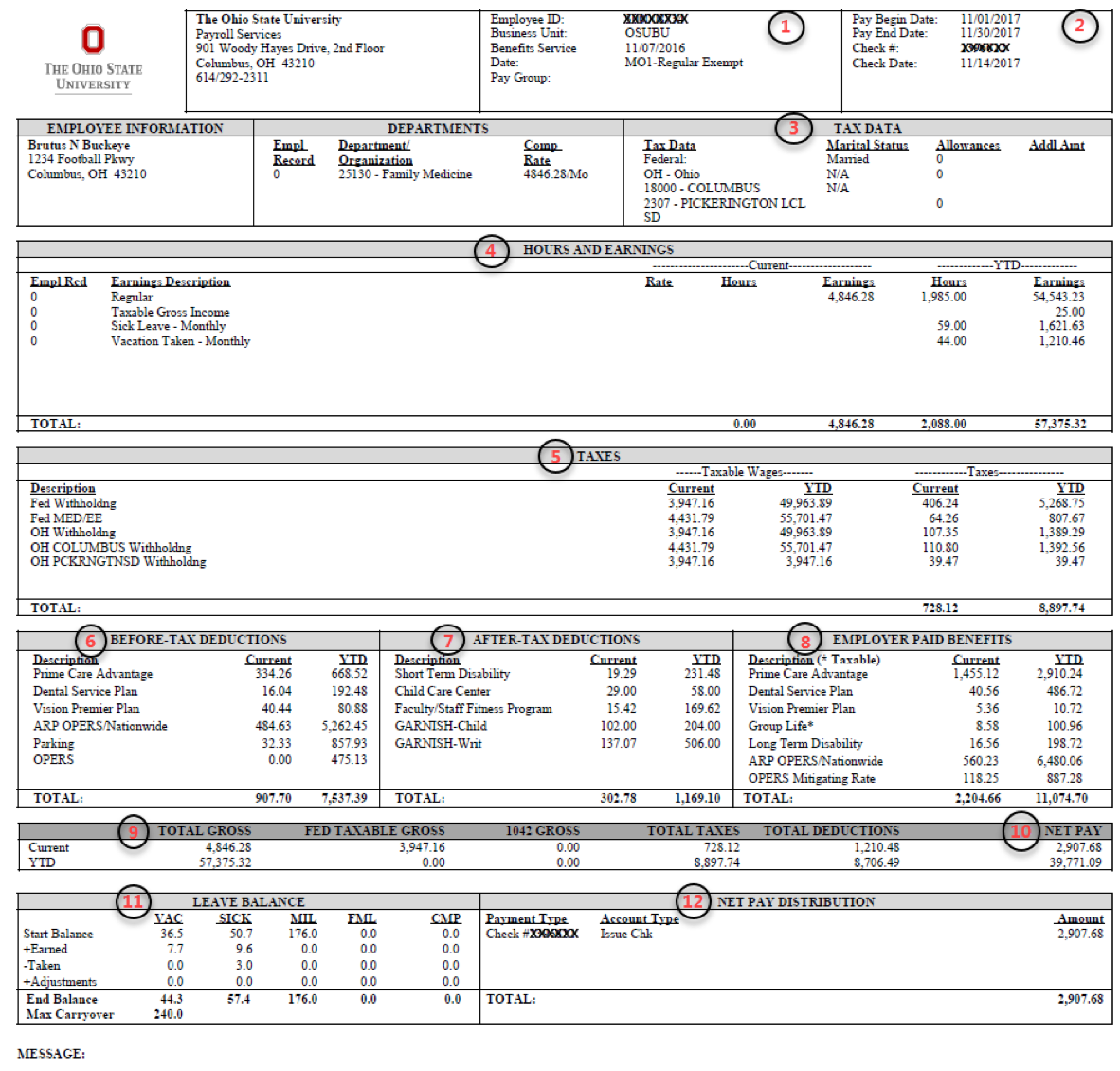

Understanding My Payslip Prior to 2021 [1]

# | Section | Description |

1 | Employee Information | This section lists your employee ID#, Pay Group, and if you are eligible (non-exempt) for overtime or not eligible (exempt). It also lists your Business Unit. |

2 | Pay Dates | Pay Period Begin and End Dates list the time period for which you are being paid. Biweekly pay is issued two weeks after the pay period end date. Check Number is displayed for all payments, but is only utilized by employees who are receiving a paper check. Otherwise, it is an internal tracking number for Direct Deposits. Check date is the date of payday. |

3 | Tax Data | The Tax Data section includes your tax withholding elections for Federal and State tax. This includes your marital tax filing status, the number of allowances you have elected, and any additional tax amounts you requested to be withheld (defaulted values are Single with 0 allowances). Your work locality is displayed here as well (resident and school district localities will also display if elected). |

4 | Hours and Earnings | The Hours and Earnings section lists your earnings information by type for the Current Pay Period and Year-to-Date. Rate, Hours, and Earnings are displayed. Earnings types include, but are not limited to:

|

5 | Taxes | The Taxes section is an itemization of the taxes that have been withheld for the Current Pay Period and/or Year-to-Date. These can include Federal, State, School District, Local, and FICA Medicare Hospitalization Insurance Tax. |

6 | Before-Tax Deductions | Before-Tax Deductions are subtracted from your earnings before taxes are calculated and subtracted. Deductions and amounts are listed for the Current Pay Period and Year-to-Date. Examples of Before-tax deductions include medical, dental and vision premiums, retirement contributions for the Alternative Retirement Plan (ARP), Public Employees Retirement System (PERS) or State Teachers Retirement System (STRS), Before-tax retirement service credit purchases, Flexible Spending Account contributions and Parking Fees. See Deductions and Mandatory Garnishments for additional information. |

7 | After-Tax Deductions | After-Tax Deductions are subtracted from your earnings after the Before-Tax Deductions and taxes have been subtracted. Deductions and amounts are listed for the Current Pay Period and Year-to-Date. Examples of After-tax deductions include donations to eligible charitable organizations, union dues, Child Support withholding and retirement service credit purchases. See Deductions and Mandatory Garnishments for more information. |

8 | Employer-Paid Benefits | The Employer-Paid Benefits section shows you the University’s cost for your benefits. Costs are listed for the Current Pay Period and Year-to-Date. These are NOT deducted from your earnings. For employees with a taxable amount of Group Term Life Insurance (GTLI), it is displayed in this box as Group Life and is added to your taxable gross income. |

9 | Summary | This summary section shows the Current Pay Period and Year-to-Date amounts for Total Gross Pay, Federal Taxable Gross Pay, Total Taxes withheld, Total Deductions withheld, and Total Net Pay. Total Gross may not match the Total Earnings in Box 4 on your paystub due to taxable fringe benefits. |

10 | Net Pay | Net pay is the balance of your pay remaining after taxes and deductions are withheld. It is also referred to as your “take-home” pay. |

11 | Leave Balance | The Leave Balance section displays Current and Year-to-Date vacation, sick time, compensatory time and military leave balances. All employees will have 176 hours of military time listed initially, but only service members on active duty may use it. Wexner Medical Center employees will not have their balances displayed here, instead, they will need to login to OneSource. |

12 | Net Pay Distribution | The Net Pay Distribution section displays the method in which you receive your pay. If you are enrolled in direct deposit, the account type, name of the financial institution, and the last four (4) digits of the account number are displayed, as well as the amount deposited into your account/s. If you receive a paper check, the check number (also seen in Box 2) will be displayed and indicate Issue Check. |