Tax Information: 1098-T

About Form 1098-T

Colleges and universities are required under Internal Revenue Code Section 6050S to issue the Form 1098-T (link is external) for the purpose of determining a taxpayer’s eligibility for various education tax credits or deductions (link is external). The form is informational only.

The information on your 1098-T will help you determine if you may claim various tax credits and/or deductions for qualified educational expenses. Your statements of account and other personal receipts (e.g., for books and supplies) may also be useful when calculating your eligibility for tax credits and deductions. Keep your 1098-T for your personal records and share it with your tax preparer, if applicable. Ohio State sends a copy of your 1098-T to the IRS.

The information on this page is intended as guidance only. Please visit irs.gov (link is external) or contact a tax professional for filing assistance. Ohio State cannot provide tax filing advice regarding Form 1098-T or your eligibility for education tax credits or deductions.

Form Eligibility and Issuance

Ohio State files Form 1098-T for each student enrolled for the given calendar year and for whom a reportable transaction is made. 1098-Ts are issued by January 31 each year. You will receive an email to your Ohio State email address address when it is available. Once issued, you can access the form on demand through your My Buckeye Link account(link is external).

Most students are eligible to receive a 1098-T. The IRS does not, however, require Ohio State to generate a 1098-T for students in specific situations. Check your Buckeye Link account to determine your eligibility.

Additional Information: Eligibility and Issuance

Populations Not Required to Receive a 1098-T

The IRS does not require Ohio State to provide a Form 1098-T for:

- Courses for which no academic credit is offered, even if the student is otherwise enrolled in a degree program

- Courses in which an E or EN grade was received

- Nonresident alien students

- Students whose qualified tuition and related expenses are entirely waived or paid entirely with scholarships

- Students whose expenses are covered by a formal 3rd party billing arrangement

Paper Copies of Form 1098-T

You consented to receive your 1098-T form electronically when completing your Financial Responsibility Statement. This is the preferred method for accessing the document, as it is available on demand.

You may request a paper copy of the your 1098-T. Call or email the Office of the University Bursar to withdraw your consent to receive the document electronically. This must be complete no later than the first Friday of spring semester. Call 614-292-1056 or email bursar@osu.edu.

Once you withdraw consent, a paper copy will be mailed by January 31 to the permanent address listed in My Buckeye Link.

Family Access to 1098-T

Your student can access their 1098-T on demand in their My Buckeye Link account. They can view, download, or print the PDF form at any time and provide it to you for tax filing purposes.

If you are an authorized contact on your student's Student Information Release (SIR), you may contact Buckeye Link to request a copy of the document. Ohio State does not offer a parent or family portal that allows you to access your student's 1098-T directly.

Resources

- View 1098-T Tax Form in My Buckeye Link

- IRS Instructions for Form 1098-T

- IRS Publication & Forms

- Form 1040 Instructions

For IRS resources: confirm you are using the most current tax year's forms and publications; the IRS routinely updates forms as the tax season nears.

Form Details

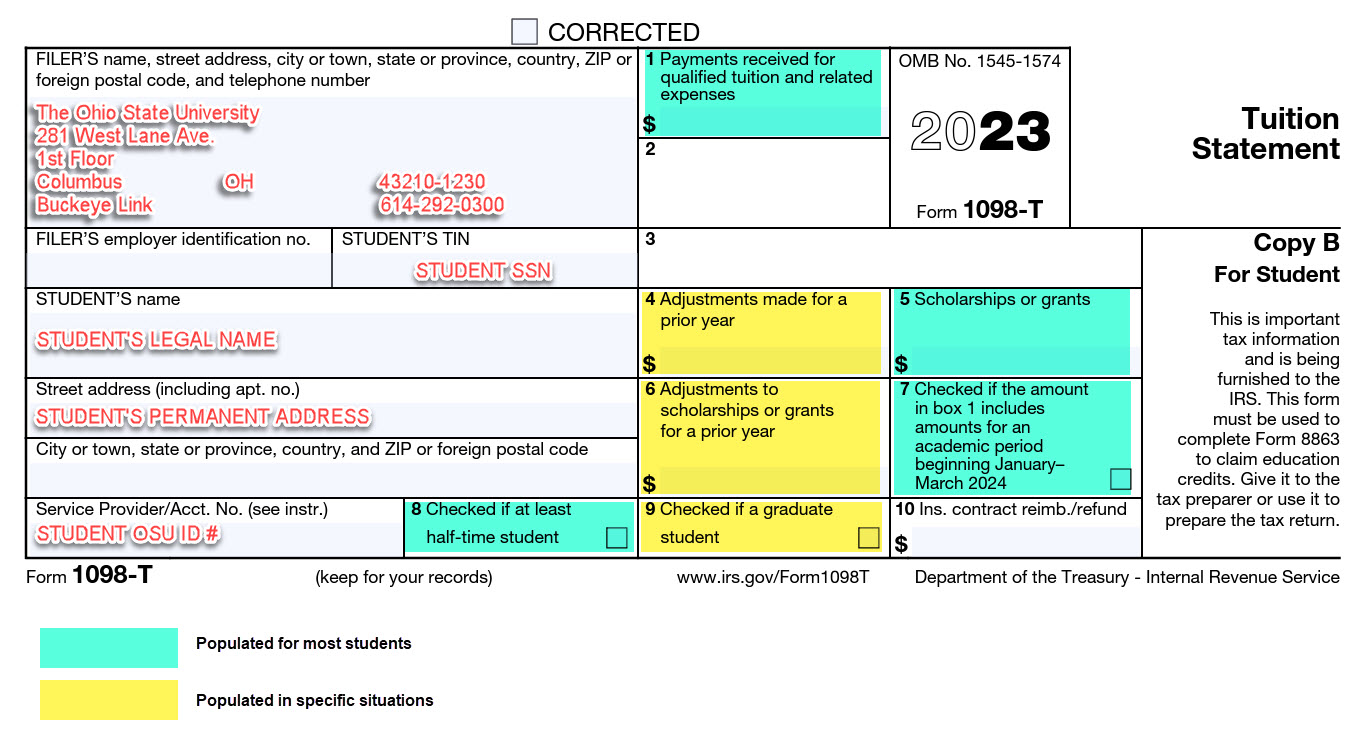

Example 1098-T

For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance at an eligible educational institution.

Ohio State reports payments received for qualified tuition and related expenses (QTRE) on IRS Form 1098-T during the reported calendar year. Box 1 on the form is a snapshot amount as of December 31. This box reflects total payments that applied toward QTRE during the calendar year (January 1 – December 31), from any source.

Additional Information: Form Details

Box Explanation

Box 1 represents payments received, from any source, for qualified tuition and related expenses.

Box 2 and Box 3 are not populated at The Ohio State University.

Box 4 shows any adjustment made by an eligible educational institution for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax liability for the year of the refund).

Box 5 shows the total of all scholarships or grants administered and processed by the eligible educational institution. The amount of scholarships or grants for the calendar year (including those not reported by the institution) may reduce the amount of the education credit you claim for the year.

Box 6 represents the amount of reductions or refunds made for scholarships or grants that were reported for a prior year.

Box 7 is checked if a reported payment was made for a semester beginning in early 2024 (January - March).

Box 8 is only checked if you have been at least a half-time student (6 credit hours for undergraduate students; 4 credit hours for graduate) for a least one academic period that began during the calendar year.

Box 9 is checked if you were enrolled as a graduate student for at least one academic period during the calendar year for which reporting is required. Box 9 is also checked for students enrolled in professional school (Medical, Dental, Optometry, Pharmacy, Law, Veterinary).

Common Qualifying and Non-Qualifying Expenses

Common Ohio State expenses that are qualifying for tax purposes and that appear in Box 1 include:

- Instructional Fee

- General Fee

- Student Activity Fee

- Non-Resident Fees

- Program Fee

- Learning Technology Fee

- Course/Clinical/Lab fees

- Over 18 Hours Surcharge

- Distance Learning Fee

- CarmenBooks Electronic Textbooks

Common Ohio State expenses that are not qualifying for tax purposes and do NOT appear in Box 1 include:

- Housing and Meal Plan

- Student Health Insurance

- Recreation Fee

- COTA fee

- Student Legal Services Fee

- Student Union Facility Fee

- TOPP Enrollment Fee

- BuckID Charges

- Late Fees and Finance Charges

- Acceptance/Application Fees

- New Student Enrollment Fee

Boxes 4 and 6 - Adjustments Made for a Prior Year

Box 4 shows any adjustment made by an eligible educational institution for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount may reduce any allowable education credit that you claimed for the prior year, which may result in an increase in tax liability for the year of the refund.

Common Reasons for Activity in Box 4

- You received financial aid or a sponsorship payment during the reportable calendar year that paid toward QTRE in a prior calendar year, which had previously been paid by payments from other sources.

- Example: You received an unsubsidized loan in January 2023 intended to pay for charges in Autumn 2022. The Autumn 2022 charges, inlcuding several QTRE, had previously been covered by a credit card payment made in September 2022. The loan received in January 2023 applies toward Box 1 on the 2023 1098-T and the September 2022 credit card payment appears in Box 4. (The September 2022 credit card payment originally appeared in Box 1 on the 2022 1098-T).

- A removal or reduction of a previously reported QTRE payment in the reported calendar year, for a semester in a prior calendar year.

- Example: A January 2023 financial aid verification revealed that you were overawarded in the unsubsidized loan applying to your Autumn 2022 charges, some of which were QTRE. The overaward (which appeared in Box 1 on your 2022 1098-T) now appears in Box 4 on the 2023 1098-T.

Box 6 represents the amount of reductions or refunds made for scholarships or grants that were reported for a prior year. It is similar to Box 4 in that it tracks reductions; however, this box captures information only about scholarships and grants, not out-of-pocket payments.

Common Reasons for Activity in Box 6

- A removal or reduction of a scholarship, grant, or sponsorship payments in the reported calendar year, for a semester in a prior calendar year.

- Example: A January 2023 financial aid adjustment resulted in a reduction to your President's Affordability Grant and Pell Grant applying toward Autumn 2022 charges, some of which were QTRE. These reductions appear in Box 6 on the 2023 1098-T. (The original award amounts appeared in Box 1 on your 2022 1098-T).

Payments Applied Toward Qualified Tuition and Related Expenses (QTRE)

Your My Buckeye Link account can help you determine which of your payments made in the calendar year applied toward QTRE in Box 1.

- Log into My Buckeye Link and, in the Finances section, select Payments from the drop down menu.

- Enter the date parameters for January 1 to December 31 for the reported year. Click the Go button.

- Choose a payment. In the Paid Amount column, click on the blue hyperlink to see what charges were paid.

- Identify the portion of the payment applying toward QTRE and write down that amount.

- Repeat Steps 3 and 4 for the remaining payments.

- Sum the portions of payments you identified as applying toward QTRE. This is the amount that should appear in Box 1 on your 1098-T.

Note: Only payments applying toward qualified tuition and related expenses are reflected in Box 1. Tuition waivers are not payments; they are charge reductions. Examples of tuition waivers include, but are not limited to Employee Tuition Assistance; Dependent Tuition Assistance; Graduate Fee Authorization; and Distance Learning Fee Waivers.

HEERF and CARES Act

The Higher Education Emergency Relief Fund (HEERF) and CARES (Coronavirus Aid, Relief, and Economic Security) Act provide funding for emergency financial aid grants to students, specifically for expenses related to the disruption of campus operations due to COVID-19.

These funds may or may not appear on your 1098-T, depending on your situation. Review the questions and answers below for more information.

Are funds I received under the HEERF reflected on my 1098-T?

It depends. If you elected to have HEERF funding apply toward qualified tuition and related expenses (QTRE), HEERF will be reflected only in Box 1 as a payment received toward QTRE. You made this election while completing an emergency grant application through the Office of Student Financial Aid. HEERF is NOT reflected in Box 5 as a scholarship or grant.

If you did not elect to have HEERF funding apply toward qualified tuition and related expenses, it will not appear on your 1098-T in either Box 1 (Payments Received) or Box 5 (Scholarships and Grants).

Please visit the IRS website for additional information about federal higher education emergency grant funding.

Are funds I received through the CARES Act reflected on my 1098-T?

No. Per guidance from the IRS, CARES Act funds issued to students will not be reflected on the 1098-T.

Why does my CARES Act funding not appear in Box 5 - Scholarships and Grants?

Ohio State scholarships are institutionally funded and awarded for a variety of reasons that are not necessarily related to the coronavirus emergency, and consequently must be reported on IRS Form 1098-T.

The CARES fund grants are awarded solely to reimburse or pay for reasonable and necessary expenses incurred as a result of the coronavirus emergency. Because of this, the university is able to designate these payments as “qualified disaster relief payments” under the law. Qualified disaster relief payments are not required to be reported on IRS Form 1098-T.

If you have questions regarding the tax treatment of your Ohio State scholarship, the university encourages you to consult with a personal tax advisor.

1098-T Frequently Asked Questions

Can't find an answer to your 1098-T question on this page? Check out our Frequently Asked Questions below. If you need further assistance, contact the Office of the University Bursar at bursar@osu.edu or 614-292-1056.

Please remember that Ohio State cannot provide tax filing advice regarding Form 1098-T or your eligibility for education tax credits or deductions.

My name, address, or other personal information has changed. Can I request an updated 1098-T?

Address Change

It depends. If you originally elected to have your 1098-T mailed to you, and have since updated your address in My Buckeye Link, you may request to have an updated form mailed to you.

Name Change

Yes, if your name changed and that change is reflected in My Buckeye Link, you may request an updated form.

SSN/ITIN Change or Acquisition

Yes, if you have obtained a SSN/ITIN and that change is reflected in My Buckeye Link, you may request an updated form.

All requests for personal information changes on 2022 1098-T tax forms must be received by the Office of the University Bursar by 5:00pm Eastern on March 8, 2024. Please call the office at 614-292-1056 or email bursar@osu.edu.

My payment was posted in the wrong year. Can you move it?

Amounts reflected on Form 1098-T are based on the timestamp associated with the posting of the transaction to your student account. After December 31, we cannot retroactively alter the timestamp of payments or financial aid transactions that were posted in a previous calendar year.

Transactions that require reposting will be timestamped with the new calendar year and may be captured as a prior year adjusted amount on next year's Form 1098-T.

I disagree with the amounts reflected on my 1098-T. Can I request a review by the Bursar?

No. Due sheer volume, we are unable to fulfill requests for personalized 1098-T calculations. Form 1098-T is used as a guide. In addition, the following may be useful when determining your eligibility for tax credits or tax deductions.

- Statement of Account - obtained from your My Buckeye Link; reflects charges and payments and their posted dates

- Cashed check images - obtained from your banking institution

- Online bank statements - obtained from your banking institution

Per the IRS, the Lifetime Learning Credit and the American Opportunity Tax Credit have maximum annual credit limits of $2,000 and $2,500 respectively.

Please remember that Ohio State cannot provide tax filing advice.

Who can claim an education credit? What are the maximum credit amounts?

You may be able to claim an education credit if you, your spouse, or a dependent you claim on your tax return was a student enrolled at or attending an eligible educational institution.

If a student is claimed as a dependent on another’s tax return, only the person who claims the student as a dependent can claim a credit for the student’s qualified education expenses.

If a student is not claimed as a dependent on another person’s tax return, only the student can claim the credit.

If you claim an exemption on your tax return for an eligible student who is your dependent, treat any expenses paid (or deemed paid) by your dependent as if you had paid them.

Per the IRS, the Lifetime Learning Credit(link is external) and the American Opportunity Tax Credit(link is external) have maximum annual credit limits of $2,000 and $2,500 respectively.

See additional restrictions for claiming the credit by visiting About Form 8863 Education Credits (link is external).

Resources

Why is Box 1 (Payments Received) on my 1098-T blank? - Prior to Tax Year 2018

Prior to tax year 2018, the IRS gave institutions the option to report either payments received in Box 1 OR amounts billed in Box 2. Ohio State chose to report amounts billed in Box 2.

To calculate payments made to Ohio State prior to tax year 2018 see the official statements of account for the semesters within the appropriate tax year. Click the “Term” arrow to view previous semesters.

Upcoming Important Dates

Related Resources

- Registration, Fees and Important Dates

- Buckeye Link

- Student Financial Aid

- My Buckeye Link Reference Guide

- Ohio Residency for Tuition

- University Housing

- Dining Services

- Student Health Insurance

- Student Legal Services

- The Graduate School

- Military and Veterans Services

- Office of International Affairs

- Admissions

- Office of Human Resources